award-winning Program

Great! Head to your company's LearnLux partner page to sign up or sign in.

Need a little help getting started? Jump to the FAQ for info on how to:

Or, click here to Contact LearnLux Support. We can be reached at support@learnlux.com.

Everybody deserves financial wellbeing benefits. If your company doesn't offer LearnLux yet, we can send you resources to ask your HR team or contact them on your behalf. Click here to request Financial Wellbeing at your workplace.

Have a question you don't see answered here? Reach out to us any time at support@learnlux.com

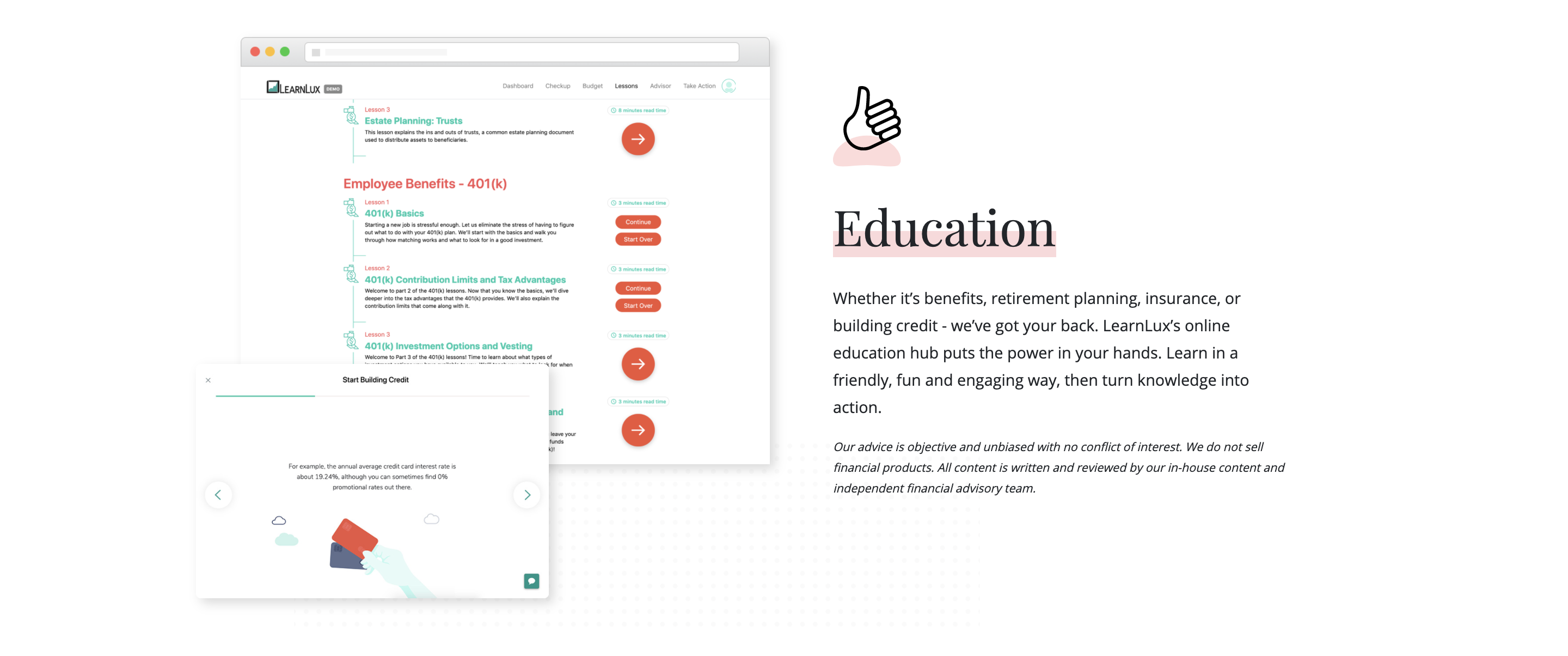

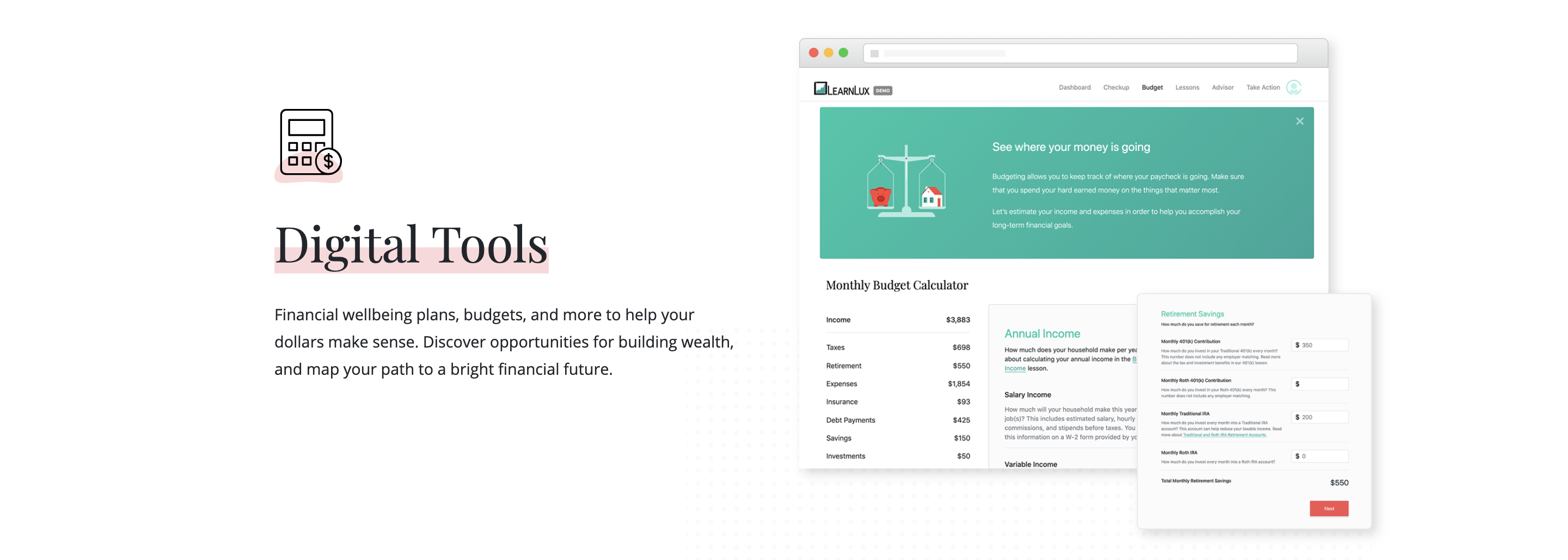

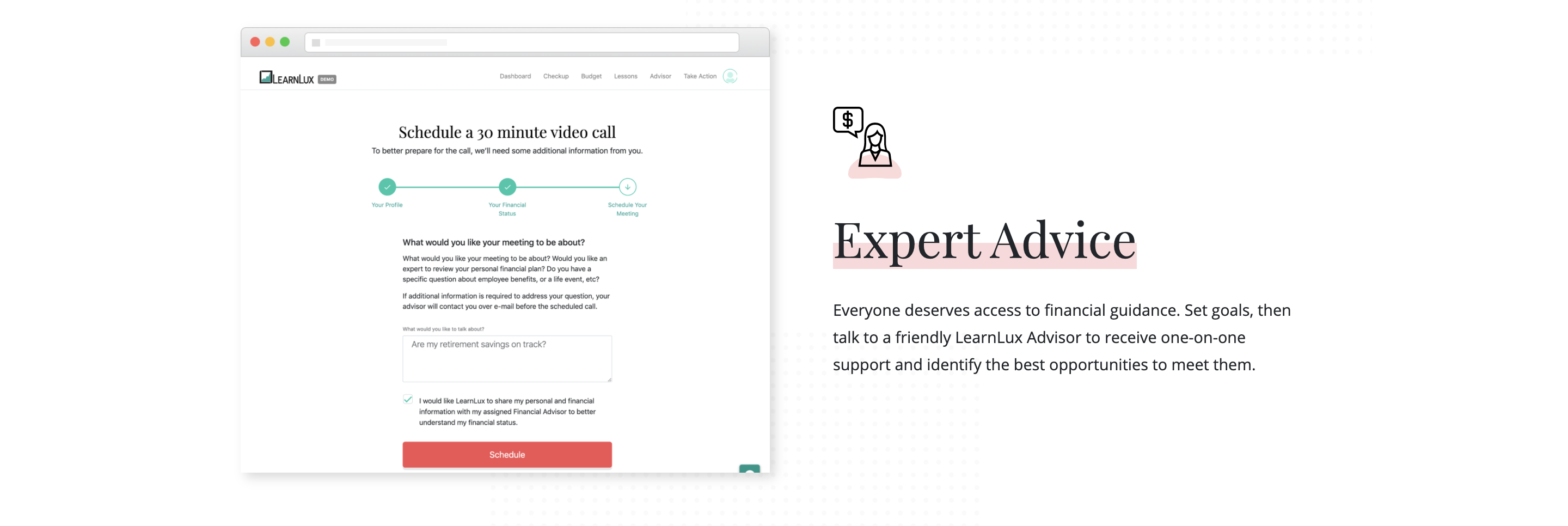

LearnLux is a financial wellbeing benefit offered at no cost to you by your employer. The personalized program allows you to learn with educational content, plan with interactive tools, and take action by speaking to an unbiased Certified Financial Planner™️ (CFPⓇ). LearnLux helps you take control of your hard-earned money so you can feel financially confident and reach your goals.

Our award-winning financial wellbeing program was created for employees of all incomes, ages, genders, races, abilities and levels of financial confidence. LearnLux’s holistic guidance helps you whether you are just starting out building credit and saving for a rainy day or preparing for big milestones like buying a home or planning for retirement.

Our offices are in Boston, MA, and Austin TX. Our team works with employers and employees across the entire United States.

LearnLux is completely independent of any financial institution. Our digital program and team of Certified Financial Planner™ professionals are fiduciaries and are the most aligned with your personal financial needs.

LearnLux is configurable and personalized for each employee. Enjoy custom employee benefits lessons, a tailored benefits portal, and support every step of the way.

LearnLux is holistic, meaning we provide financial planning, guidance, and education to meet your needs in all phases of life.

The LearnLux program is built to be digital-first and is accessible on desktop, mobile, tablet, and any internet-enabled device.

Head to your company's LearnLux partner page to sign up or sign in. Can't remember your login page URL or need help signing up? Reach out to us at support@learnlux.com.